tax sheltered annuity calculator

A tax-sheltered annuity TSA also referred to as a tax-deferred annuity TDA plan or a 403 b retirement plan is a retirement savings plan for employees of certain public. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal.

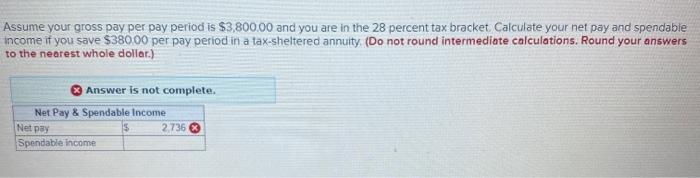

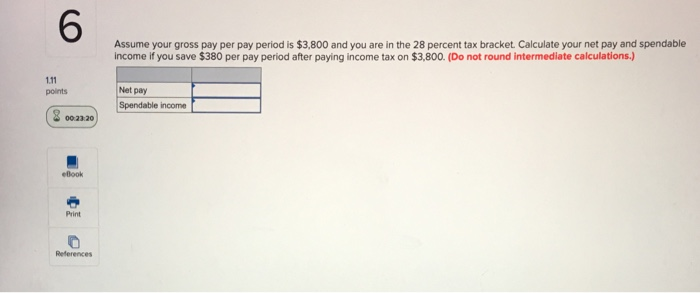

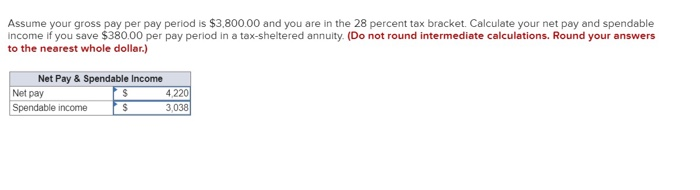

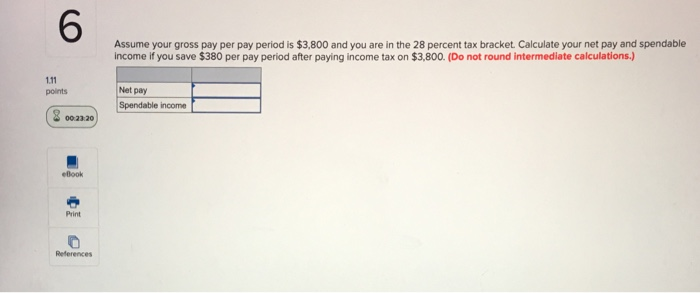

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain.

. Content updated daily for annuity tax calculator. A 403b is a type of tax sheltered annuity plan which allows you to invest pretax earnings in a retirement account and allow those funds to grow tax-free as well. A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment.

When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered annuities. How Does a Tax Sheltered Annuity Work. Related Annuity Payout Calculator Retirement Calculator.

In the US one specific tax-sheltered annuity is the 403b planThis plan provides employees of certain nonprofit and public. A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. A Fixed Annuity can provide a very secure tax-deferred investment.

Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. New Look At Your Financial Strategy. Do Your Investments Align with Your Goals.

Ad We Believe Diverse Perspectives and High-Conviction Investing Can Produce Better Results. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. The terms tax-sheltered annuity and 403b are often used interchangeably.

Learn some startling facts. Find a Dedicated Financial Advisor Now. A 403 b plan.

IRS Publication 575 Pensions and Annuity Income defines a qualified plan as one of the following. Understanding a Tax-Sheltered Annuity. Ad Annuities are often complex retirement investment products.

A Qualified employee retirement plan including qualified cash or deferred. The payment that would deplete the fund in a given number of years. Ad Learn More about How Annuities Work from Fidelity.

Because annuities offer many benefits lottery winners. Ad This is the newest place to search delivering top results from across the web. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they.

Tax Sheltered Annuity TSA Contribution Limit Formula Please click a link below for the year you would like to calculate contributions. A tax-sheltered annuity can also be referred to as a tax-deferred annuity TDA or a 403b retirement plan. An annuity is an investment that provides a series of payments in exchange for an initial lump sum.

Visit The Official Edward Jones Site. If you withdraw money from your. 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Ad Learn More about How Annuities Work from Fidelity. In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt. IRC 403 b Tax-Sheltered Annuity Plans. Discover Must-Read Insights to Help You Navigate Todays Market.

Learn More on AARP. An annuity is a financial instrument that accrues interest on a tax-deferred basis and protects against market risk and longevity risk.

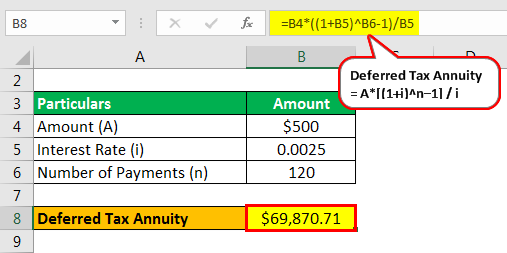

Tax Deferred Annuity Definition Formula Examples With Calculations

Withdrawing Money From An Annuity How To Avoid Penalties

The Tax Sheltered Annuity Tsa 403 B Plan

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

Tax Deferred Annuity Definition Formula Examples With Calculations

Obamacare Investment Tax Problem For High Income Earners

The Best Annuity Calculator 17 Retirement Planning Tools

How Much Guaranteed Income Does An Annuity Pay Per Month 2022

What You Should Know About Tax Sheltered Annuities The Motley Fool

What Is A Straight Life Annuity Retirement Watch

Annuity Taxation How Are Annuities Taxed

Tax Deferred Annuity Definition Formula Examples With Calculations

Solved 6 Assume Your Gross Pay Per Pay Period Is 3 800 And Chegg Com

Annuity Investment Calculator Investment Annuity Calculator

Tax Sheltered Annuity Plan Lovetoknow

The Best Annuity Calculator 17 Retirement Planning Tools

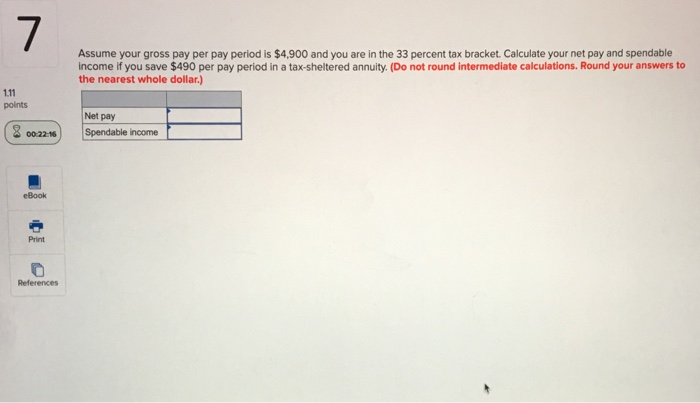

Solved Assume Your Gross Pay Per Pay Period Is 4 900 And Chegg Com

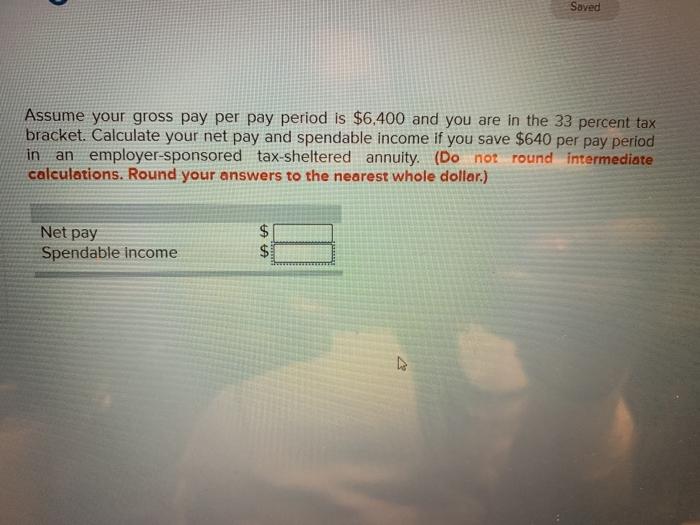

Solved Saved Assume Your Gross Pay Per Pay Period Is 6 400 Chegg Com